The 401(k) for federal employees: Thrift Savings Plan

The Thrift Savings Plan has been thrust into the spotlight

The Thrift Savings Plan, a 401 (k) for federal workers, is well known among government employees but gained even more notoriety this month after President Trump told the fund's top brass he doesn't want its funds invested in Chinese stocks.

TRUMP ORDERS FEDERAL RETIREMENT MONEY INVESTED IN CHINESE EQUITIES TO BE PULLED

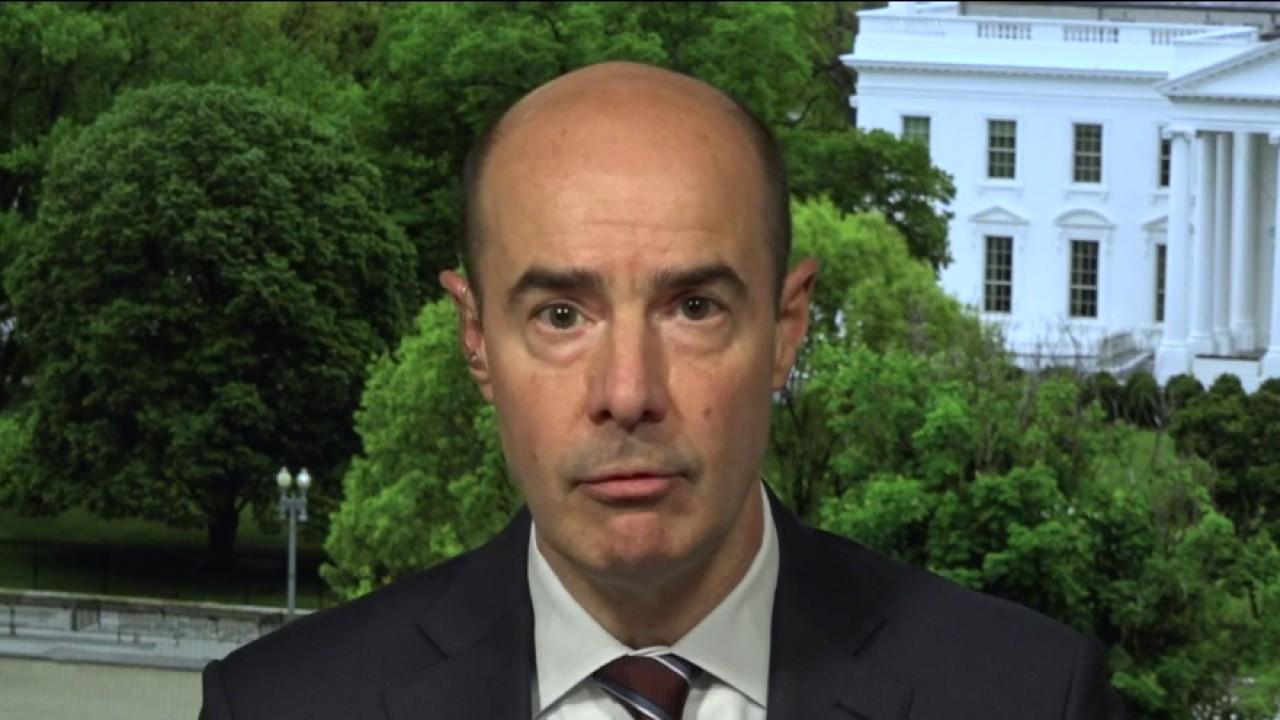

The request, which was first reported exclusively by FOX Business, was made by National Economic Council Chair Larry Kudlow and National Security Advisor Robert O'Brien, in a letter to U.S. Labor Secretary Eugene Scalia, who notified the fund's top leadership.

FOX Business takes a look at this 401 (k)/pension plan, which is the largest in the country and perhaps the world.

US FEDERAL EMPLOYEES DON'T NEED CHINESE STOCKS IN 401(K)S: SECRETARY SCALIA

President Ronald Reagan

In June of 1986, President Ronald Reagan signed into law the Federal Employees’ Retirement System Act.

The National Institute of Retirement Security described it as "one of the most well-known transformations of a pension system," transferring federal employees from the Civil Service Retirement System to a retirement system that encompassed Social Security, a defined-benefit pension, and a defined-contribution savings plan.

Photo by Dirck Halstead/The LIFE Images Collection via Getty Images/Getty Images

401 (k) Powerhouse

Known as TSP for short, the Thrift Savings Plan is the "retirement savings and investment plan for federal employees and members of the uniformed services," according to its website. It "offers the same types of savings and tax benefits that many private corporations offer their employees under 401(k) plans."

“It’s the largest 401(k) in the world, [including] about 1.3 million veterans," labor officials told FOX Business.

CLICK HERE TO READ MORE ON FOX BUSINESS

Assets Under Management

Its $600 billion in assets make it the largest pension fund in the country, followed by California Public Employees and California State Teachers, as tracked by Pensions & Investments.

Presidential Appointees Oversee

TSP is managed by five presidentially-appointed board members who are directed to manage the "TSP prudently and solely in the interest of the participants and their beneficiaries."

Chairman Michael Kennedy was appointed by President Obama and confirmed by the U.S. Senate.

Kennedy received the letter below from Secretary Scalia communicating President Trump's wishes for the fund to avoid Chinese stocks.

Sec Scalia to Chairman Kenn... by FOX Business on Scribd

Kennedy, according to his bio, is also managing director in the Atlanta office of Korn/Ferry International and a member of the firm's global financial services practice, specializing in commercial/investment banking, capital markets, and asset management searches.

GET FOX BUSINESS ON THE GO BY CLICKING HERE